Securities

A security is an investment, typically considered to be a stock, bond, or some other less common type of investment contract. Companies issue and sell securities to raise capital. For example, a business may wish to purchase a competitor, but not have enough money to make the purchase. It could issue and sell bonds to investors, allowing the company to quickly raise enough money to purchase the competitor. Why would investors buy the bonds? Because they have excess capital (money sitting around) and are willing to part with it now in order to earn more later.

Securities Markets

A securities market is a marketplace where securities, typically stocks and bonds, are bought and sold by investors. Such markets exist to allow investors to easily buy and sell securities. You may own 100 shares of Apple stock and wish to sell it so that you have enough money for a down payment on a new car. If you had to sell your stock without the benefit of a securities market, you might place an online ad on Craigslist or post it for sale on eBay. It might take days or even weeks to find a buyer. Securities markets link buyers and sellers together so that if you offered your 100 shares of Apple for sale at the going market price, you would likely sell your stock in seconds. Liquidity is the ability of an asset to be converted to cash quickly without needing to discount the price. Stocks listed on organized exchanges offer excellent liquidity. Real estate, while perhaps being a good long-term investment in many cases, does not offer the same liquidity. An investor needing to sell some real estate quickly will likely need to discount the price dramatically and still wait a month or more for the deal to close and the cash to change hands.

A CLOSER LOOK AT APPLE

Apple uses the ticker symbol AAPL and trades on the National Association of Securities Dealers Automated Quotation (NASDAQ) exchange, an electronic exchange that operates without a physical trading floor. The New York Stock Exchange (NYSE) operates a physical trading floor and facilitates electronic exchanges of securities, as well.

Primary and Secondary Markets

Companies raise capital by issuing and selling stocks and bonds in the primary market. For example, a company may wish to raise $100 million for the purpose of expansion. The company will usually contact an investment bank who has experience in issuing stocks and bonds for assistance. The investment bank issues and sells the stock and/or bonds for a fee, so to raise $100 million for the company, the investment bank may sell $105 million worth of stock, keeping $5 million for its services and giving the remaining $100 million to the company. All of this takes place in what is called the primary market. The primary market is not an actual physical marketplace, but rather a theoretical one in which a security is sold for the first time. A company raises its capital in the primary market.

Let's assume that the company above issued and sold $100 million of stock in the primary market. That stock was actually sold by the investment bank. The investment bank wants to sell the stock as efficiently as possible, so it typically sells the stock only to its biggest clients who can buy it in huge blocks, perhaps buying $10 million or more. Who are these big clients? For the most part, they are institutional investors such as hedge funds, mutual funds, and pension funds with billions of dollars of investments, with a few wealthy individuals possibly being included in this mix of clients. These institutional and wealthy investors buy the stock in the primary market at a predetermined price set by the investment bank. Let's assume that the investment bank set the price at $20 per share in the primary market, so an institutional investor would need to buy 500,000 shares in order to invest $10 million.

The institutional investor waits for the stock to be listed on an exchange, perhaps the NASDAQ or NYSE, then has the opportunity to sell it to other investors. This sale through one of the exchanges takes place in the secondary market. All money made by investors, be they institutional or small, regular investors, is made in the secondary market. Only the company and the investment bank make money in the primary market. The stock can be sold over and over again in the secondary market, sometimes for a profit, other times for a loss.

Let's assume that the company above issued and sold $100 million of stock in the primary market. That stock was actually sold by the investment bank. The investment bank wants to sell the stock as efficiently as possible, so it typically sells the stock only to its biggest clients who can buy it in huge blocks, perhaps buying $10 million or more. Who are these big clients? For the most part, they are institutional investors such as hedge funds, mutual funds, and pension funds with billions of dollars of investments, with a few wealthy individuals possibly being included in this mix of clients. These institutional and wealthy investors buy the stock in the primary market at a predetermined price set by the investment bank. Let's assume that the investment bank set the price at $20 per share in the primary market, so an institutional investor would need to buy 500,000 shares in order to invest $10 million.

The institutional investor waits for the stock to be listed on an exchange, perhaps the NASDAQ or NYSE, then has the opportunity to sell it to other investors. This sale through one of the exchanges takes place in the secondary market. All money made by investors, be they institutional or small, regular investors, is made in the secondary market. Only the company and the investment bank make money in the primary market. The stock can be sold over and over again in the secondary market, sometimes for a profit, other times for a loss.

Stock

Stock is a security that represents ownership, meaning that an investor who owns stock has an equity position in a company and is a stockholder or shareholder. The image to the left is a stock certificate that indicates that the holder owns 100 shares of stock in the company. Today paper stock certificates are rarely, if ever, used. Instead, electronic records of stock ownership are kept.

Corporations are the only legal form of business ownership that issue stock. Privately held corporations issue stock to owners, but do not offer it publicly for sale on exchanges. Privately held corporations are generally small, but there are a few large privately held corporations such as Meijer, Mars, and Menard's. Publicly traded corporations are typically very large and allow their stock to be traded on exchanges such as the NASDAQ and NYSE. Examples include Wal-Mart, Microsoft, and Google.

Corporations are the only legal form of business ownership that issue stock. Privately held corporations issue stock to owners, but do not offer it publicly for sale on exchanges. Privately held corporations are generally small, but there are a few large privately held corporations such as Meijer, Mars, and Menard's. Publicly traded corporations are typically very large and allow their stock to be traded on exchanges such as the NASDAQ and NYSE. Examples include Wal-Mart, Microsoft, and Google.

The stock charts listed above are for the common stock of the corporations. Common stock represents ownership or equity in the company. An investor who owns shares of a corporation is a part owner. The investor bought the stock to make money. There are two ways this can happen. First, the investor can buy low and sell high. For example, if the investor bought the shares at $20 per share and sells them at $50 per share, the investor made a profit of $30 per share. Another way an investor can make money is to buy the shares and receive dividends. Dividends are a portion of the profits that are paid directly to shareholders. Not all companies pay dividends, so this method of making money does not work for all companies.

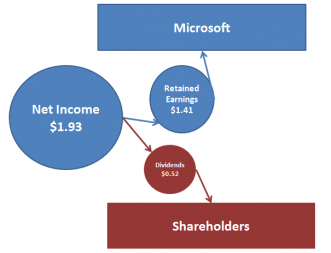

Microsoft often makes a lot of money. In 2009 the company earned $14.5 billion in net income, which works out to be $1.93 per share of stock. To reward investors, Microsoft issued a dividend, actually four quarterly dividends, that paid investors $0.52 per share for the year. The remaining $1.41 per share in net income was classified as retained earnings and invested back into the company to hopefully make more money.

Common stock dividends are not guaranteed and are paid only if the Board of Directors of the company determines that money is available and votes in favor of issuing a dividend.

Common stock dividends are not guaranteed and are paid only if the Board of Directors of the company determines that money is available and votes in favor of issuing a dividend.